Leading the Personal Investing design team

About my role

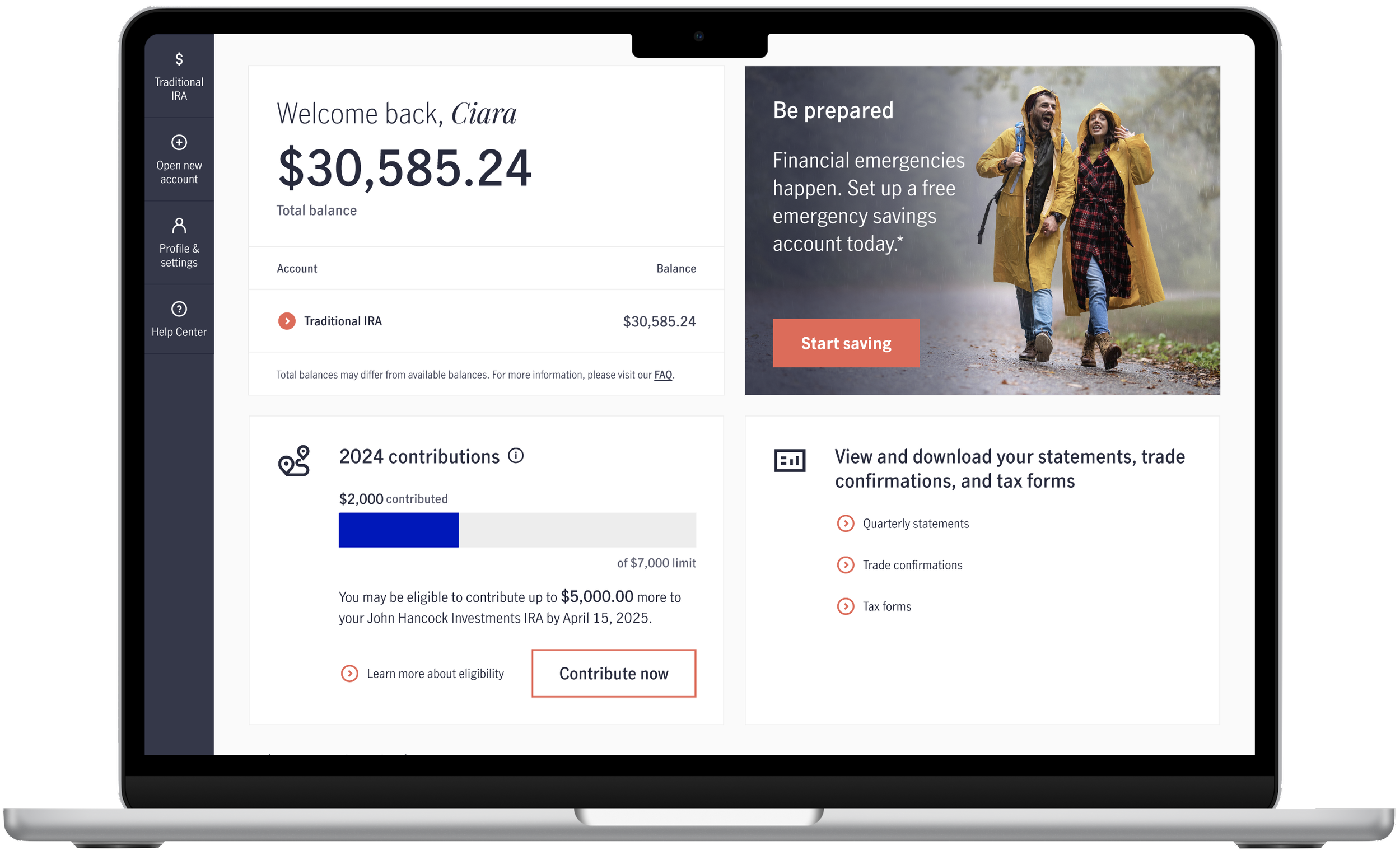

The Personal Investing business supports ~130k customers, primarily through rollover IRAs that are directly held mutual fund accounts, managed IRA accounts, and Emergency Savings accounts.

I lead the small design team responsible for the end-to-end customer experience once participants leave their employer plan—from completing a rollover into a John Hancock IRA to managing their accounts over time.

My team focuses on making complex financial decisions clear and approachable—helping customers feel informed, confident, and in control throughout their investing journey.

Design stories

Helping customers stay invested

Reducing premature withdrawals through clearer understanding of taxes and penalties.

Context

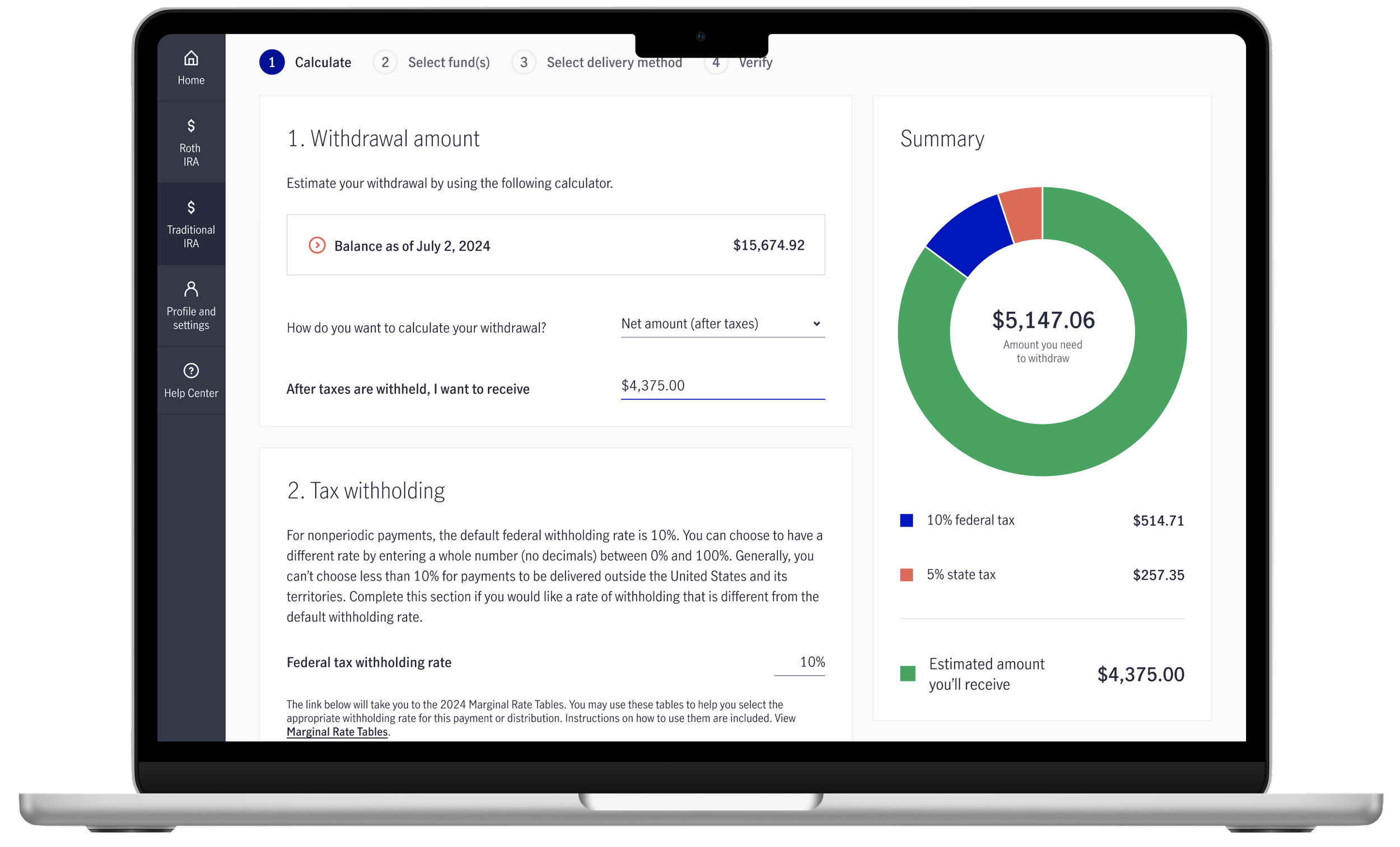

Customers frequently initiated partial withdrawals without understanding tax and penalty implications—eroding long-term savings and account value.

Approach

Introduced a new withdrawal landing experience and interactive calculator that clarified tax eligibility and visualized estimated deductions in real time. Coached my direct report through the redesign, focusing on simplifying decision points and reinforcing trust.

Impact

Reduced premature partial IRA withdrawals by 2–4% across multiple time periods, retaining over $3.2M AUM in the first few months post-launch.

Simplifying fund selection

Reducing rollover abandonment with EasyRoll

Context

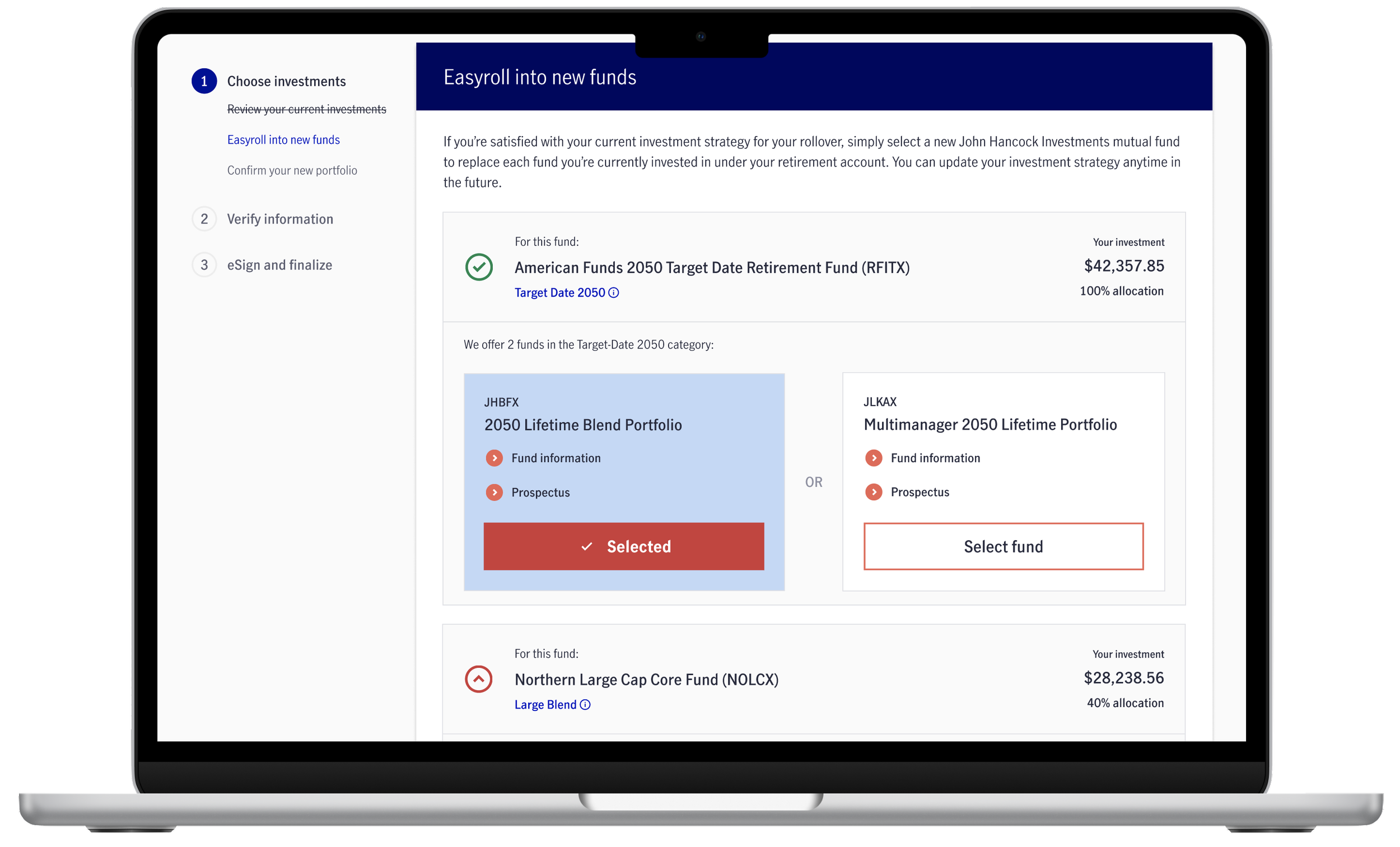

The digital rollover converted poorly (~25%) because customers were asked to make investment decisions they didn’t understand.

Approach

Designed EasyRoll, which automatically matches each customer’s 401(k) holdings to the John Hancock IRA fund using Morningstar categories—offering a compliant, low-effort default path.

Impact

Simplified a complex, high-friction process and improved rollover completion by making investment selection effortless.

Design demos that scaled influence

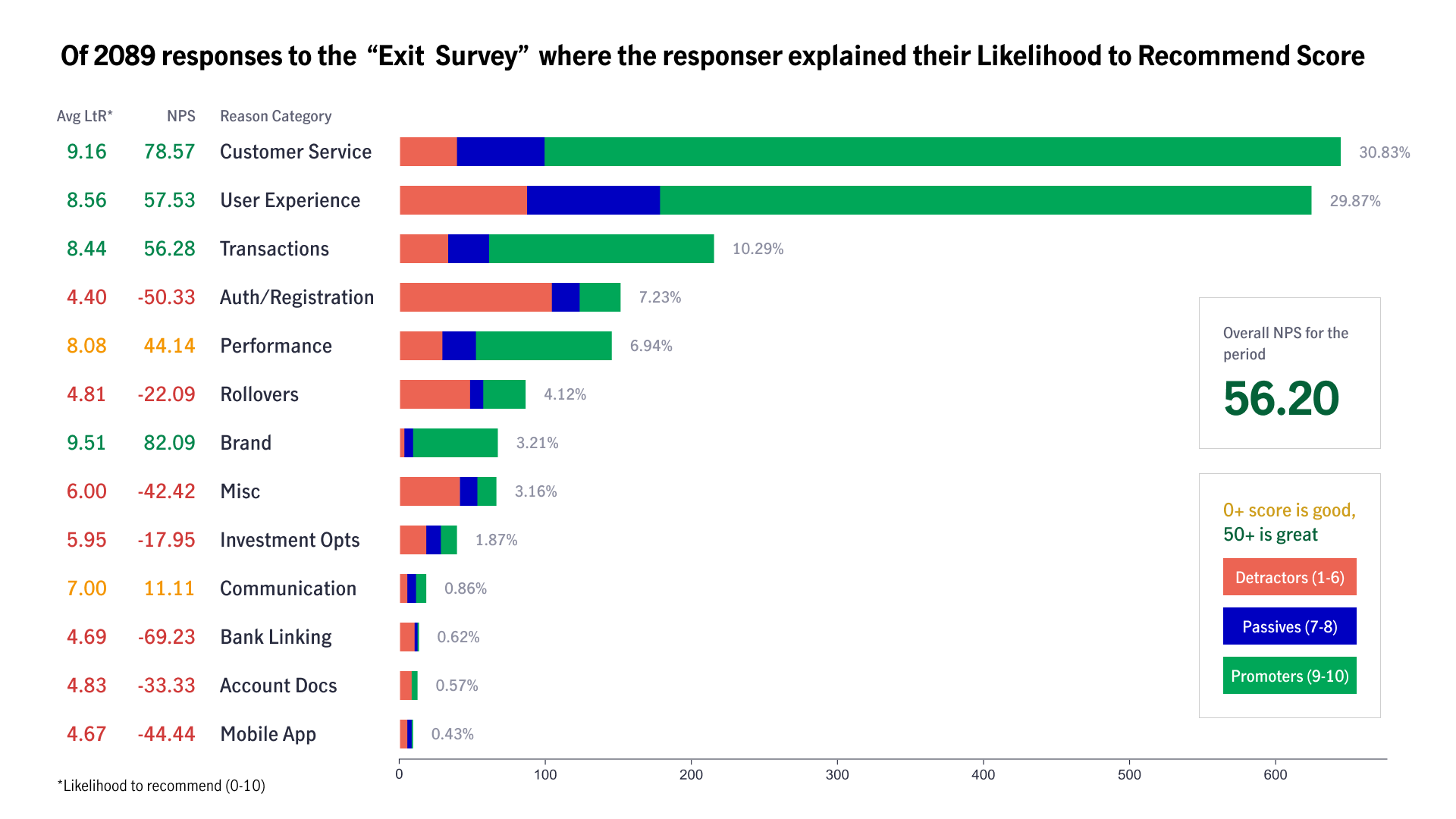

Slide from a Design Demo highlighting customer sentiment patterns across 2,000+ NPS responses.

Creating a forum for shared understanding across product and operations

Context

Before these demos, partners across engineering, operations, TA, customer service, legal, and compliance often didn’t know why features were being built until the engineering demo—leading to surprise and misalignment.

Approach

I introduced a separate Design Demo series focused on the why behind our work, sharing early concepts and insights from NPS and analytics to align teams before development began.

Impact

The format built trust and reduced last-minute rework. Partners who once felt out of the loop became active collaborators, and many invited peers from other product teams to observe the sessions as an example of insight-driven development.

Winning an AI hackathon

Using AI to turn 47,000 daily session recordings into actionable insights

Context

We were selected from GWAM’s AI backlog to explore how AI could generate insights from Decibel, our session replay tool. With tens of thousands of sessions recorded daily, manually watching replays was slow, inconsistent, and impossible to scale.

Approach

As product owner, I led a small cross-functional team—mostly new grads—through concept framing and delivery.

We built a dashboard prototype with AI-generated summaries, experience scores, and natural language querying to group sessions by user intent and link back to replays. I designed and prototyped the interface in Figma Make during the two-day hackathon.

Impact

We won the Manulife Global Wealth & Asset Management AI Hackathon, recognized for demonstrating how AI can scale qualitative insight generation and transform how teams understand digital behavior.

More projects

-

H1's People Search

-

DFCI Curation Platform

-

Terra Data Explorer